what is the average interest rate on a student loan and its benefits

The average interest rate on a student loan is generally between 4 and 7 percent. The benefits of a student loan are that it can help you pay for your education and it can also help you build your credit.

1. What is the average interest rate on a student loan?

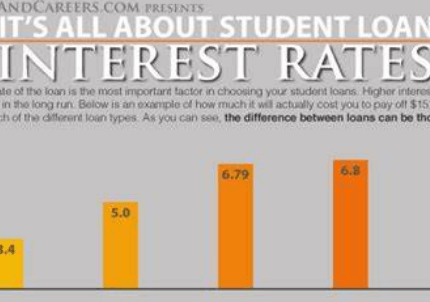

It is a common question, how much average interest rate one has to pay on a student loan. In order to calculate the average interest rate on a student loan, we must first understand the types of interest rates that are available.

Fixed interest rates stay the same for the life of the loan, while variable interest rates can change. The majority of student loans have a fixed interest rate.

The average interest rate for a fixed rate student loan is 4.29%. This means that if you have a $10,000 loan with a 4.29% interest rate, you will owe $10,429 after 10 years.

The average interest rate for a variable rate student loan is 2.84%. This means that if you have a $10,000 loan with a 2.84% interest rate, you will owe $10,284 after 10 years.

2. What are the benefits of average interest rate of a student loan?

These loans are typically offered by the government, and they usually have very low interest rates. In addition, student loans often have very flexible repayment terms, which can make them very affordable for students.

There are many benefits of taking out a student loan. First, as mentioned above, student loans typically have very low interest rates. This means that you will not have to worry about accruing a lot of interest on your loan. Additionally, student loans often have very generous repayment terms. For example, many student loans do not require any payments until after you have graduated from school. This can give you a lot of flexibility in terms of your budget.

3. What are the different types of average interest rate loans?

The Different Types of Loans

The type of loan that you choose should be based on your individual needs and financial situation.

1. Personal Loans

Personal loans are typically unsecured, which means they are not backed by collateral. This makes them a good option for borrowers with good credit who are looking for a relatively small loan. Personal loans can be used for a variety of purposes, such as consolidating debt, funding a large purchase, or making a home improvement.

2. Student Loans

Student loans are designed to help borrowers pay for their education. There are two main types of student loans: Private student loans are offered by banks and other financial institutions and typically have variable interest rates.

3. Auto Loans

Auto loans are typically secured loans, which means they are backed by collateral. The collateral for an auto loan is usually the vehicle that is being purchased. Auto loans are a good option for borrowers who are looking to finance the purchase of a new or used vehicle.

4. What are the terms and conditions of a loan?

The terms and conditions of a loan are the rules and regulations that the borrower and lender agree to follow. These can vary depending on the type of loan, the lender, and the borrower’s financial situation. However, there are some common terms and conditions that are typically included in most loans.

The first is the interest rate. This is the percentage of the loan that the borrower will have to pay back in addition to the principal. The interest rate can be fixe, which means it will stay the same for the life of the loan, or it can be variable, which means it can change over time.

The second common term is the repayment period. This is the amount of time that the borrower has to repay the loan. The repayment period can be shorter or longer, depending on the terms of the loan.

Conclusion

The average interest rate on a student loan is about 4.29%. Student loans offer a wide range of benefits, including fixed interest rates, tax breaks, and flexible repayment plans. Student loans can help you pay for college and reduce your overall financial burden.