what is the average interest rate on a home loan in market

When you’re ready to buy a home, one of the biggest decisions you’ll have to make is whether to borrow money from a bank or take out a home loan. And, like with most things in life, there are pros and cons to each option. In this blog post, we will explore the pros and cons of borrowing money from a bank vs. taking out a home loan. We’ll also provide an estimate of the average interest rate on a home loan in today’s market.

What is the average interest rate on a home loan in the market?

The average interest rate on a home loan in the market is around 4%. However, there are many different lenders and rates can vary quite a bit.

How to calculate your mortgage payment

There are a few ways to calculate your monthly mortgage payment. One way is to divide your total mortgage principal, including interest and fees, by the number of months in the loan term.

The other way is to multiply your mortgage balance by 1.054 and then add in any applicable taxes and insurance premiums.

What are the Mortgage Insurance Rules?

The mortgage insurance rules govern what kind of mortgage products (i.e. fix-rate, adjustable-rate, etc.) can be offer to consumers by the lenders who participate in the government-sponsor mortgage insurance program. A recent change in the rules allows for an increase in the interest rate on adjustable-rate mortgages that are insure by the Federal Housing Administration (FHA).

What are benefits of Home Equity Loan?

There are many benefits of a home equity loan, including the ability to borrow more money than you would be able to get on a conventional loan. Additionally, a home equity loan offers some flexibility in terms of repayment schedule and interest rate, making it an attractive option for borrowers with variable income or who need to take advantage of short-term financial opportunities. There are also a few disadvantages to consider before taking out a home equity loan. For example, if you have low credit score or inadequate collateral, you may not be approve for a home equity loan.

Conclusion

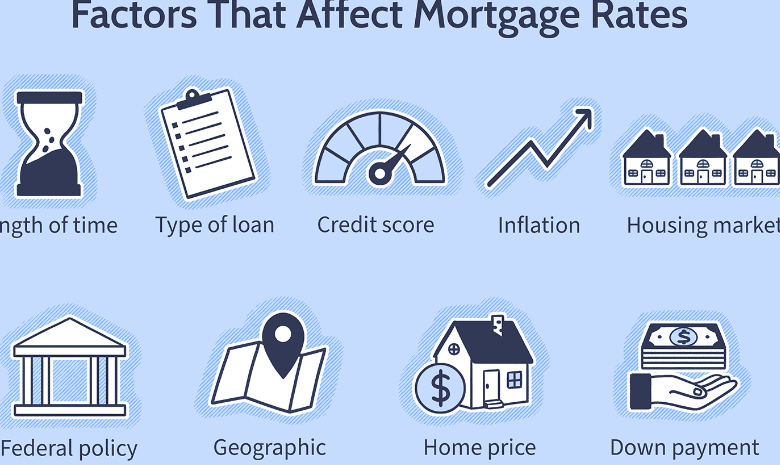

There is no one answer to this question as the interest rate on a home loan will vary depending on a variety of factors, including the credit score of the borrower, the type of loan being offer and whether or not there are any pre-existing conditions on the property. However, in general, you can expect to pay around 4% – 5% above the base rate for a variable-rate mortgage and around 2% – 3% above the base rate for a fix-rate mortgage.