what is loan consolidation policy

When you have a lot of debt, it can be tough to manage your finances. That’s why it’s important to have a loan consolidation policy in place. This policy will help you combine several smaller loans into one large loan, which will make paying off your debts much easier. Here are four things to keep in mind when creating your loan consolidation policy.

What is a loan consolidation policy?

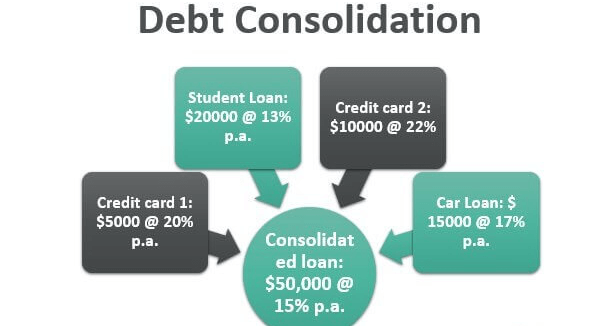

What is loan consolidation? Loan consolidation is an important banking policy that allows you to combine multiple loans into one loan. This reduces the total amount of interest that you will pay on your loans, which can save you money in the long run.

There are a few things to keep in mind when it comes to loan consolidation. You should always speak with a qualified financial advisor to get the best advice for your specific situation. Additionally, make sure you understand all of the terms and conditions of your loan consolidation policy before signing anything.

If you’re eligible for a loan consolidation program, be sure to submit all of the necessary paperwork as soon as possible. If you don’t take care of this step, your bank may not be willing to offer you a program. Finally, make sure you stay current on your payments so that you won’t have to worry about defaulting on your loan consolidation policy later on down the road.

What are the benefits of a loan consolidation policy?

When you take out a loan, the bank or lender gets rights to all of your income and assets for a specific period of time. This means that if you can’t repay the entire amount due on your loan, the lender can seize your assets. A loan consolidation policy is a way to reduce your monthly payments on several loans into one payment. This could help you avoid having to sellassets or borrow against them in order to meet payday or other short-term obligations.

The benefits of a loan consolidation policy depend on a few factors, such as the interest rate and terms of each individual loan. Generally speaking, however, a consolidation policy can:

Reduce your monthly payments by consolidating multiple debts into one payment;

improve your credit score by decreasing the number of open debt accounts; and

Create more manageable financial obligations overall by reducing the total amount borrowed.

What are the risks of a loan consolidation policy?

There are a few potential risks associated with a loan consolidation policy.

The first potential risk is that the interest rates on the new loans may be higher than those on the original loans. This is because when a loan is consolidated, the lender may be able to get access to more information about the borrower’s credit history and ability to repay. This could lead to higher interest rates being charged on the new loans.

Another potential risk is that if a borrower defaults on one of the new loans, then they may be unable to repay all of them. If this happens, then foreclosure could take place and the borrower could lose their home.

Who can benefit from a loan consolidation policy?

Loan consolidation is a process where you combine multiple loans into one, in order to lower your interest rate and monthly payment. This can benefit many people, depending on their particular situation.

those who are struggling to pay off their existing debt: consolidating your debts into one loan will decrease the amount you have to pay each month, which could help you reach your financial goals more quickly.

those with low credit scores: having multiple loans with different interest rates can make it difficult to get approved for a new loan. Consolidating your debts will improve your credit score, which could make it easier to get a new loan in the future.

those with high interest rates: if you have high interest rates on existing loans, consolidating them into one loan may be the best option for you. This will reduce the amount of money you have to pay each month, and could potentially save you money in the long run.

Conclusion

If you are considering loan consolidation, it is important to understand the policy of your lender. A good loan consolidation policy will help you to understand how much money you will be borrowing and what type of terms the loans will have. It is also important to know if there are any fees or penalties associated with consolidating your loans. By understanding your lender’s policies, you can make the best decision for your financial situation.