What Is An Installment Loan And Its Types

When you think about borrowing money, what comes to mind? Most likely, you envision a traditional bank loan where you deposit money and the bank gives you a fixed amount of money to spend. But there’s another kind of loan out there that’s growing in popularity – an installment loan. With an installment loan, you borrow money over time and pay back the borrowed amount gradually, usually with monthly installments. Here are three types of installment loans: short-term, long-term, and hybrid. And whichever type of instalment loan is best for you depends on your specific needs and preferences. So whether you’re in the market for a new car or just need some extra cash flow to tide you over until your next paycheck, read on for all the details.

what is an installment loan

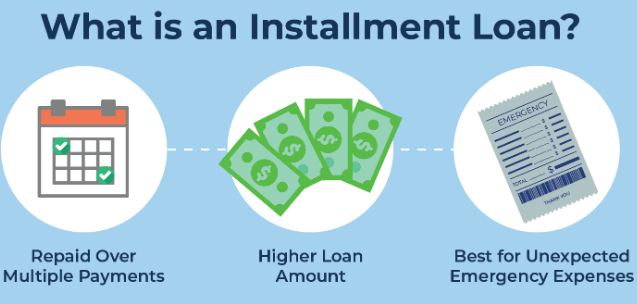

So, what is an installment loan?

An installment loan is a type of loan that typically has a set number of repayments over a period of time, such as monthly, quarterly, or yearly. There are a few different types of installment loans: unsecured, secured, and residential. Unsecured installment loans are the most common and tend to be the cheapest. Secured installment loans are slightly more expensive but offer some security features, such as a security deposit or mortgage escrow account. Residential installment loans are usually the most expensive and require you to live in the property until it’s paid off.

An installment loan is a loan that is paid back time

There are many types of installment loans, but the most common are short-term and long-term loans.

Short-term installment loans are typically for up to three months and have fixed interest rates. These loans can be used to cover short-term financial needs, such as covering unexpected expenses or getting ahead on your debt payments.

Long-term installment loans are usually for more than three months and have variable interest rates that can change throughout the life of the loan. These loans can be used to cover longer term financial goals, such as paying down high-interest debt or saving for a down payment on a home.

There are a few important things to keep in mind when borrowing an installment loan:

1) The total amount you borrow should be smaller than the total amount you plan to pay back over time. This will help you avoid paying more in interest than you need to.

2) Make sure you understand your loan’s terms and conditions before signing anything. If there’s anything you don’t understand, ask your lender for clarification.

3) Be sure to keep your monthly payments as close to your original budgeted amounts as possible. Making small adjustments during the repayment process can help make the entire process smoother and less stressful.

There are 4 types of installment loans

An installment loan is a type of loan that provides consumers with short-term credit to cover the cost of large purchases, such as a car or house. There are four types of installment loans: auto, personal, mortgage, and business.

Auto loans are the most popular type of installment loan. Auto loans allow you to borrow money to buy a car or truck. You must pay back the entire loan, plus interest, within twelve months.

Personal loans are also popular. Personal loans allow you to borrow money to purchase items like furniture and appliances. You must pay back the entire loan, plus interest, within thirty-six months.

Mortgage loans are used for buying homes. Mortgage lenders usually require borrowers to repay their mortgages in equal installments over time. Most mortgages have an initial period of ten years during which you must make regular payments on your debt. After this initial period, your mortgage lender may approve a longer repayment period if you can afford it.

Business loans are used to finance businesses and other important projects. Businesses usually need more money up front than people do for personal or auto loans because they have higher risks associated with them (for example, if the business fails). Businesses also have shorter repayment periods than personal or auto loans because they often have shorter terms than ten years or more than thirty-six months.

Pros and Cons of an installment loan

An installment loan is a short-term, unsecured loan that borrowers repay over time, typically with interest. There are two main types of installment loans: direct and indirect.

Direct installment loans are made to consumers who have an established credit history and can demonstrate a ability to repay the loan in full on schedule. Direct installment loans may be offered by banks, credit unions, or other lenders.

Indirect installment loans are made to consumers who do not have an established credit history but who can provide documentation that they will be able to safely repay the loan in full over time, including regular income and other sources of repayment such as Social Security checks or home equity lines of credit. Indirect installment loans may be offered by banks, credit unions, or other lenders.

There are three main types of indirect installment loans: split-payment, graduated-payment, and continuous-payment.

Conclusion

An installment loan is a type of loan where you make small, regular payments over time. This can be a great way to get the money you need to buy a car or take care of other big expenses, without having to borrow all at once. There are several different types of installment loans available, so it’s important to compare them carefully before making a decision. Hopefully this article has helped you understand the basics of installment loans and given you some ideas about which option might work best for you.